| CURRENT ISSUE | |||||||||||||||||||||||||||||||

|

Portugal and European Integration, 1947-1992: an essay on protected openness in the European Periphery

Lucia Coppolaro1 Abstract

Keywords

Resumo

Palavras-chave

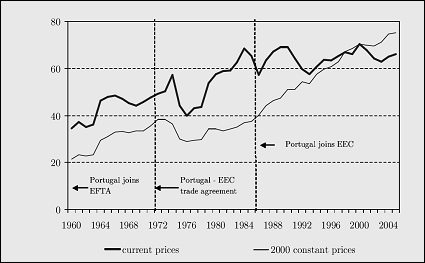

Introduction Portugal’s membership of European institutions dates back to the period of the Estado Novo, when the country was ruled by a dictatorial regime, and its integration continued steadily through the following decades, peaking with its joining the European Economic Community (EEC) in 1986. The first steps leading to that integration began with its joining the Marshall Plan in 1948, thereby becoming a founding member of the Organization for European Economic Cooperation (OEEC). In 1950, Portugal joined the European Payments Union (EPU), and in 1959, the European Free Trade Association (EFTA). In 1962, it joined the General Agreement on Tariffs and Trade (GATT), and finally, in 1972, Portugal signed a free trade agreement with the EEC. The analysis of such longstanding commitment to European integration sheds light on Portuguese political history, as well as illustrating the many ways that European integration proceeded, particularly in the western periphery of the continent. In fact, the analysis of the commitment of a peripheral and backward country, ruled by a dictatorial regime, sheds light on the history of European integration outside the group of industrialized and more developed countries. This article also analyzes the economic policy followed by Portuguese governments from the end of World War II onward, paying particular attention to the way in which policies that promoted domestic institutional development and stimulated the economy were related to measures that increased the degree of market openness. At the same time, this analysis considers the major developments that were taking place in the context of European integration. We have two main objectives. Firstly, this article will assess Portugal’s economic policy in the framework of the history of European integration. The main contention is that Portuguese economic policy followed patterns that were quite similar to those that we can find elsewhere in continental Europe, even before the democratic revolution of 1974–1976 and Portugal’s accession to the EEC in 1986. Throughout the period analyzed here, the driving force of economic policy in Portugal was a combination of state intervention with measures designed to increase the exposure of the domestic economy to international market forces, above all, on a regional basis. Thus Portugal was pursuing the same economic policy as the more industrialized and democratic Western European countries. Secondly, this article shows that, when Portugal finally joined the EEC in 1986, most trade barriers with the rest of Western Europe had already been dismantled, with the exception of those relating to agricultural goods and fisheries and, more importantly, trade with Spain. This helps to explain the relative ease of the integration of the Portuguese economy into the EEC economy after 1986 and helps to clarify the true relevance of the membership which, seen in this light, appears relatively less important. Portugal’s experience shows that European integration was not fostered by only EEC/EU membership, but that it could also be favored by other European institutions, such as the OEEC, EPU, and EFTA, and by international institutions, such as GATT. This article thus assesses the impact of Portugal’s quest to join Europe on the history of European integration, by showing the relevance of the history of European integration beyond the history of the EEC/EU. I. The OEEC years, 1947–1958 The reconstruction of the European economy after World War II was grounded in the double aim of promoting economic growth with full employment—in order to achieve social and political stability—and giving a new role to Germany, which in the past had been a major engine for European growth. These two objectives were achieved through regional cooperation, which allowed for state intervention in the economy while maintaining an openness to market forces and international competition. The aim of the Marshall Plan and of the institutional framework of the OEEC and the EPU, established in 1948 and 1950 respectively, was to provide a solution for Western European reconstruction by assisting the recovery of European trade and, at the same time, help to solve the German question by assisting its democratic and economic reconstruction in a peaceful context. The OEEC and the EPU sought to ensure cooperation between the member states with a view to removing quantitative restrictions, and to contribute to the reestablishment of multilateral payments. State intervention and trade liberalization were thus pursued within a European regional framework.3 Initially, the Portuguese dictatorial government led by Salazar rejected the offer of Marshall aid and displayed an ambiguous position toward European cooperation, taking the official position that the country’s development did not require any external assistance.4 However, the difficult economic situation in which the country found itself led the government to reverse its initial position. World War II had had a positive impact on Portugal’s balance of payments, as exports had increased and imports dwindled. Yet a large share of the gold and foreign exchange reserves thus accumulated had to be spent in 1947 on large imports of foodstuffs due to the bad agricultural production of that year. The pressing need for dollars caused the government to change its ideas regarding the Marshall Plan.5 The fact that Portugal had joined the OEEC at its commencement, and then the EPU, meant the abandonment of the autarkic policies of the prewar period, calling for participation in the new European economic order and the endorsement of the same economic policy as the one pursued by the other Western European countries.6 Crucially, this change in strategy was not announced publicly, as the government continued with its imperial rhetoric, presenting its situation as incompatible with European integration.7 The Portuguese government was not unprepared for Portugal’s being opened up to international competition or for its economic integration with the other European countries: in fact this process was accompanied by government intervention, exactly as was happening in the other Western European countries.8 By the time Portugal joined the OEEC, its economic policy was essentially contained within the 1935 Law of Economic Reconstitution, scheduled to remain in force until 1950. This law was the Portuguese state’s first economic plan and the keystone for the many economic intervention tools created or reinforced by the state during its period of autarky in the 1930s. It detailed the new functions that the state sought to exercise and those it was permitted to exercise following the financial recovery for which Salazar was responsible during his first years in government. Moreover, the law sought to establish a framework for public and private investment by promoting the construction of infrastructures and the creation or strengthening of those industrial sectors that were considered to be of strategic importance for the national economy. In 1952 a new economic plan, the First Development Plan, was published, covering the years from 1953 to 1958. The plan consolidated the state’s determination to intervene in the construction of infrastructures and to promote manufacturing as well as the agricultural sector.9 Participation in the OEEC, the Law of Economic Reconstitution, and the First Development Plan represented the framework for what would become the economic policy of the New State, continuing practically until its downfall. The first represented the beginning of Portugal’s association with the institutions of economic cooperation and international trade regulation, making its opening up to the outside world possible without endangering other policies aimed at favoring the country’s economic specialization. The Law and the Plan gave the state the necessary levers for influencing this economic and industrial specialization. This framing of economic policy was accompanied by other measures that proved to be of equal help and consisted of policies designed to control inflation and the prices of some essential products, as well as policies designed to ensure that the public accounts were balanced and to uphold the value of the currency.10 Thus, from the end of World War II onward, the economic policy pursued by Portugal in the 1950s followed similar patterns to those of the other Western European countries: the opening up of the market and state intervention. II. The EFTA years, 1959–1974 For the six governments that signed the Treaty of Rome in 1957, which established the EEC, the new Community was an instrument intended to guarantee what was seen as essential for their economic growth: maintaining the dynamism of the flow of exports to an area, the hub of which was the Federal Republic of Germany, by means of a regional trading area protected from international competition. In this regional and protected area, trade barriers would be eliminated, and exports, considered essential for economic growth, would increase.11 As rapid and deep integration required some similarities in terms of economic structures, peripheral nations were excluded from the EEC because of their limited potential for integration. In the case of Portugal, however, political questions were also important, given the difficulty of allowing a dictatorship to join institutions ruled by democratic principles. In any case, the exclusion of Portugal from the EEC did not mean that there was any interruption to this country’s pattern of integration with other Western European countries. Exports are essential for a small country, and Portugal had the chance to benefit from the reaction to the creation of the EEC on the part of the more industrialized OEEC countries, which in 1959 established the European Free Trade Association (EFTA) as a means of dismantling customs tariffs on industrial products. Portugal’s membership of this new international institution can be considered exceptional, as it was the only non-industrialized country allowed to join. The governments and producers of the United Kingdom and the other EFTA members could have resisted the incorporation of a low-wage country into their free trade area. However, because of the small size of the Portuguese economy, they were willing to make an exception. By becoming a member of EFTA, the Portuguese government was obliged to begin dismantling its customs barriers, although it did negotiate special clauses that allowed it to proceed at a more gradual pace, thereby giving its emerging industrial sectors some time to adapt. In addition to this, Portugal managed to guarantee the opening up of EFTA markets to exports of some of the country’s processed agricultural products—which it succeeded in having defined as industrial product—and thereby benefited from the lower duties of its EFTA partners. Taking on yet further obligations to liberalize, Portugal joined GATT in 1962.12 This opening up of the Portuguese economy stimulated the development of the industrial structure and, as a result, Portuguese textiles and other light industrial products started to penetrate Western European markets. While the share of agricultural products decreased after 1960, the share of textiles, apparel, and footwear rose from 16 percent in 1958 to 30 percent in 1973. A similar trend appeared in exports of chemicals and machinery. In this sense, EFTA membership led to a substantial increase in trade and, to a certain extent, in foreign investment, as well as a surge in export-oriented industries in sectors where Portugal had a comparative advantage. It should, however, be noted that, despite the important role that EFTA played in increasing Portuguese exports, the expansion of its exports to EEC countries became even more important since both the Federal Republic and France were, at that time, the motors of Western Europe’s economy due to their size and rapid growth.13 Thanks to the opening up of trade achieved with membership of EFTA and GATT, the share of exports in GNP increased from 15 percent in the 1950s to 26 percent in 1973. Moreover, as Figure 1 shows, the degree of openness of the Portuguese economy increased substantially from 1960 to 1972. Measured at constant prices, it increased from 20 percent to almost 40 percent, while at current prices it increased from 35 percent to almost 50 percent. Figure 1: Trade openness ratio (imports and exports as a percentage of GDP; current prices)  Source:Amador, Cabral, and Maria, “International trade patterns over the last four decades: how does Portugal compare with other cohesion countries?” 4. Figure 2 makes a comparison between the degree of openness of the Portuguese economy and those of the other EU Cohesion Fund beneficiaries: Ireland, Spain, and Greece. It also shows that, together with Ireland, Portugal was the country that most opened up its economy in the 1960s. Figure 2: Trade openness ratio (imports and exports as a percentage of GDP; constant 2000 prices)

Source: Amador, Cabral, and Maria, “International trade patterns over the last four decades: how does Portugal compare with other cohesion countries?” 4. The growth in industrial exports, remittances from emigrants, and capital imports allowed Portugal to maintain its external balance with low levels of inflation and a relatively stable exchange rate. Such a favorable external balance of payments enabled the government to continue with its policy of low interest rates and a balanced budget, thus encouraging the growth of both private and public investment. Opportunities for private investment in industry closely accompanied the structural transformations in internal demand resulting from improvements in living standards and the increase in external demand. The service sector grew in the same manner, primarily in banking and other financial services, commerce, health, and education. In the meantime, the Portuguese government used the finances made available as a result of the favorable macroeconomic situation to promote industrialization programs through direct intervention or the application of powerful protection mechanisms. The intervention of the Portuguese state in industry was mainly directed toward those sectors that were considered fundamental, such as energy production and transport. Without this intervention, the country’s electricity grid would not have expanded so rapidly, nor would it have been able to develop a cement industry, a national iron industry, fertilizers, or chemicals in general. These sectors were not new to the country, and their expansion depended—to a large extent—on accumulated experiences, particularly during the interwar period. However, none of them would have grown at the rate that they did without state support. It must be stressed that this support was not merely indicative or marginal; on the contrary, it involved substantial financial assistance and guaranteed market controls. In some sectors, the existence of colonial markets—particularly for the sale of goods—was a distinct advantage, especially now that there was no advantage to be gained from the supply of colonial primary resources.14 Following the policies established during the 1930s, agriculture in Portugal continued to enjoy strong state protection via the regulation of markets, price controls, and public investment in infrastructure. Nevertheless, this protection was not sufficient to enable the sector to respond to the loss of labor to industry, the service sector, and emigration. And in fact, it was during the 1960s, a period of strong industrialization and growth in industrial exports that, for the first time, Portugal’s agricultural sector experienced a population loss, accompanied by a sharp decline in production.15 The Salazar government’s economic policy during these years continued to be marked by the development plans that came to be important references not only for the actions of the government itself but also for the corporative infrastructure that was being formed and helped banks and industrial and agricultural companies to make decisions. The Estado Novo revealed itself not so much through the definition of a corporatist regime but through the fact that it had successfully managed to have its directives followed by a large network of public and private institutions, with the peak of this entire organization being occupied by the development plans.16 Table 1 gives an idea of the importance of the development plans by illustrating their share of Portuguese GDP. Table 1: Economic Planning in Portugal (1935–1973)

Source: Lains, “O Estado e a industrialização em Portugal, 1945–1990,” 928. The fact that the country was enjoying a phase of greater openness to the outside world did not impede the continuation of its domestic interventionist policies. The agreement with EFTA gave the government flexibility and space for these interventions. Portugal’s high level of state intervention, which was not unique in continental Europe, was compatible with the gradual opening up of the economy to external trade: indeed, it was an element that facilitated the opening of the borders to foreign products. Portugal’s membership in EFTA represented a phase of internationalization of the Portuguese economy that also allowed for state intervention. For this reason, the period of EFTA membership can be described as a period of controlled openness, during which the state maintained—and even increased—its role in the management of the economy. This happened in Portugal just as it also happened in other European countries, whether or not they were members of the EEC. Portugal was therefore following policies similar to those pursued by most of the other Western European countries, characterized by the removal of trade barriers and public intervention in the economy. The Estado Novo’s economic policy entered a period of decline during the final phases of the regime, and in particular during Marcello Caetano’s consulate. This decline owed much to increases in the degree of political debate and to the problems the Portuguese economy began to face at the end of the 1960s. Even if the good rate of growth persisted, the increasing budgetary difficulties caused by the colonial wars, previously unknown increases in inflation levels, and the impact of the international recession came to trouble the Portuguese economy. It was against this background that Portugal had to face the first enlargement of the EEC in 1973, which incorporated the United Kingdom, Denmark, and Ireland. The enlargement of the EEC undermined the role of EFTA, as the United Kingdom and Denmark were forced to leave this organization. At this point, it became essential for Lisbon to look for a solution that would enable Portugal to strengthen its trade preferences with the enlarged EEC. The solution was provided by the bilateral Free Trade Agreements (FTA) that the EEC signed with those countries that remained in EFTA. The agreement between the EEC and Portugal was signed in 1972 and proved to be crucial in enabling tariff barriers to be dismantled in the industrial sector, a process that was practically completed by the time Portugal eventually joined the EEC in 1986.17 In this sense, membership of EFTA (and then the FTA signed with the EEC) played a key role in dismantling trade barriers. III. Revolution, crisis, and recovery, 1974–1986 The termination of the Bretton Woods agreement over exchange rate policy in 1971–1973 and the hike in oil prices during the autumn of 1973 brought an end to two decades of international economic growth and monetary stability.18 The 1970s was a period of economic crisis, during which almost all countries suffered from inflation, a balance of payments deficit, and a sluggish rate of economic growth. In this period, the EEC tried to adapt to the international economic crisis and the accompanying exchange rate turbulence and to assimilate the first enlargement. The governments of the EEC member states reacted to the contraction of the international economy and the rising inflation and unemployment rates by introducing national economic protection measures. This reemergence of state protection was possible because the EEC lacked the effective powers to intervene in many aspects of market regulation and state subsidies. At the same time, the EEC members reacted to the exchange rate instability by trying to move from transatlantic cooperation to EEC cooperation, with the creation of the Snake agreement in 1973 and then with the establishment of the European Monetary System (EMS) in 1979. Moreover, they made decisions that would prove to be crucial for its subsequent development, such as the institutionalization of the European Council in 1975, the direct election of members to the European Parliament in 1979, and the implementation of the EEC regional policy.19 The development of the EEC regional policy was favorable to Portuguese economic policy and deserves some more attention here. The EEC Summit at The Hague in 1969 and the “completion, deepening, and enlargement” objectives it set (foreseeing the entry of new members with backward regions and the implementation of the monetary union) enlarged the support base for the regional policy as a way of reducing regional inequalities and favoring a balanced development of the Community. During the accession negotiations, the United Kingdom, Ireland, and Denmark supported the creation of a Regional Development Fund (as it came to be known) and were joined not only by the less developed member, Italy, but also by France and Germany, interested in implementing a monetary union. While there remained some disagreement over the way in which the Fund would be financed, even the more liberal stances accepted the principle that the enlargement of the Community to less developed areas and the implementation of the monetary union had to be accompanied by financial compensations for the weaker economies. Therefore, once again, in the economic policy of the EEC, the further opening up of the economies that would follow its enlargement to include new members or the creation of a monetary union would be accompanied by state intervention.20 This was the EEC that in the 1980s would undergo a second enlargement, with the entry of Greece in 1981, followed by Portugal and Spain in 1986. The military coup of April 1974 and the inauguration of the democratic period with the first constitutional government two years later improved the possibility of Portugal becoming a member of the EEC. Thus, Portugal’s democratization and the transformation of the EEC as a result of its 1973 enlargement paved the way for Portugal’s later membership. The Community was no longer a small group of countries with fairly similar per capita income levels, a large degree of interdependence, and important political affinities. This eased the enlargement while the internal EEC development with the implementation of a common regional policy seemed to further increase the advantages that Portugal could enjoy from membership. In 1977, Portugal’s Prime Minister, Mário Soares, called for negotiations to be opened with a view to Portugal’s membership. Formal negotiations began in October 1978, but it was not until 1980 that discussions of substantive matters finally got under way, coming to an end in 1984. The long road to membership resulted from the fact that the Portuguese economy was not in any condition to bear rapid membership and the fact that Portugal—and the world—had entered a recession.21 Portugal’s economic problems were not born with the 1974 revolution, nor were they brought about by the 1973 oil shock. Rather they were the result—in no particular order of significance—of the country’s involvement in colonial wars and the consequent difficulties of military finance, a profound crisis in agricultural production (with knock-on effects for the country’s trade deficit), the slowdown of industrial growth, the difficulties of financing the emerging social security system, and state-controlled price subsidies. Between October and November 1973, oil prices quadrupled, aggravating the inflationary tendencies that had been felt since the end of the 1960s. For the first time in decades, the rate of inflation in Portugal reached 20 percent in 1974. As Figure 1 shows, the increase in Portugal’s degree of openness to trade was reversed between 1974 and 1976, both in nominal and real terms. This change is explained by the fact that the revolutionary period led to an increase in relative unit labor costs and, consequently, to a reduction in real exports, while real imports decreased as a result of the postponement of investment decisions. Furthermore, the decline in the degree of trade openness measured at current prices was also due to monetary shocks. In fact, the sharp increase in inflation after April 1974 was not accompanied by nominal exchange rate depreciations, thus leading to an increase in the GDP deflator that was higher than that of exports and imports. The Estado Novo’s institutional framework was rigid, and it very soon demonstrated its unsuitability for dealing with a situation of inflationary pressure.22 The rigidity inherited from the Estado Novo was not challenged by the governments that followed the 1974 coup. The first provisional governments, not yet openly Marxist or collectivist, were far too weak to confront the discontent that the necessary price increases would bring. The populist governments that followed in 1975 were happy to retain the measures controlling both prices and salaries, as they formed part of the extreme left’s model of governance. Moreover, the governments that emerged after the coup had yet to come to terms with the fact that public sector wages had not been adjusted to match the increases in prices, and were forced to make extraordinary increases to these salaries while also introducing a national minimum wage. Other significant sources of disequilibrium resulted from the huge influx of Portuguese nationals coming to the country from the former African colonies and the reduction in the remittances being sent by Portuguese emigrants in Europe, as well as the decline in exports and capital imports. Portugal’s economic problems did not differ much in essence from those that affected the rest of Western Europe. The other countries also felt the need to make important changes to the structure of their economies because of the reduced external competitiveness of some industrial sectors, particularly the more traditional ones connected with basic industries.23 Spain and Portugal took an important step toward their future EEC membership by signing a bilateral trade agreement in 1980. The trade agreements made by the two countries with the EEC in 1970 and 1972 respectively had effectively led to important reductions in customs tariffs with the European partners but had done nothing to advance the liberalization of trade relations between the two Iberian countries. However, the 1980 agreement did not extend to three crucial areas, notably the reduction in trade barriers, the fisheries sector, and the reduction in agricultural tariffs. It was only with EEC membership that these three important areas would also be liberalized.24 IV. EEC and EMU membership, 1986–1992 Like the 1970s, the 1980s were also characterized by the combined effects of an enlargement of the Community, the deepening of existing policies, and the launch of new ones. These developments favored Portuguese membership. By the end of the 1970s, the objective of establishing a common market—set by the Treaty of Rome in 1957—had not been achieved. As tariff barriers were being phased out, EEC members began to erect new barriers among themselves, leading to a fragmentation of the common market. Because of this combination of a poor macroeconomic performance and the failure to achieve a real common market, pressures started to mount: a comprehensive and systematic response was required to address the problems created by the “incomplete” Europe and to resolve what had become known as “Eurosclerosis.” The arguments in favor of completing the Community market were supported by the idea that the abolition of the barriers existing to the free circulation of labor, capital, goods, and services, together with the reduced intervention of the state in the economy, would lead to productivity gains and economic growth.25 It was against this background that the EEC member states took the initiative to stimulate economic growth by continuing to promote market integration and liberalization at both a regional and a multilateral level. At a multilateral level, negotiations were started in 1986 at the Uruguay Round of GATT with a view to enhancing the liberalization of international trade; at a regional level, in the same year, the EEC member states signed the Single European Act (SEA), which formalized the Community’s commitment to the implementation of a single market by December 1992 through the introduction of reforms leading to the free circulation of goods, capital, services, and people. At the same time, the EEC members were aware that, if they wished to further enhance economic growth, it was also necessary to enlarge the market. Thus, in the same year as the SEA was signed, Portugal and Spain became new members.26 The SEA established a direct link between the creation of a single market and the need to promote economic cohesion within the EEC. The first Delors package for 1988–1992 increased the size of structural funds for investment in infrastructures and human capital. In this way, it linked the creation of the single market to an increase in transfers to poorer countries or regions, in order to help them improve their competitiveness.27 The enlargement that brought Greece, Spain, and Portugal into the Community was thus associated with the reaffirmation of the principle that richer countries should contribute more fully in order to compensate for the short-term negative effects of opening up the economies of the less developed countries, in order to allow the EEC economy to grow in a more balanced way. Thus, EEC economic policy favored Portugal at a time when the country was undergoing considerable political and economic transformations thanks to the convergence of the interests of the two main parties in the “Bloco Central” (Central Bloc) governments. Stabilization had been associated with changes to some of the political fundamentals inherited from the most intense revolutionary period. The 1982 revision of the Constitution abolished the Council of the Revolution, which up until then had been playing an increasingly less significant role in the political system. It was also necessary to revise that part of the Constitution stating that the 1975 nationalizations of the banking sector were irreversible. Domestic stabilization passed an important test with the balance of payments crisis provoked by the second 1979 oil shock and the European recession that followed. In 1979 and in 1983, the Portuguese governments signed agreements with the International Monetary Fund (IMF) for loans that would allow for a restructuring of the foreign debt while helping to restore external equilibrium. Such loans were accompanied by budget cuts and tax increases, undertaken by the “Bloco Central” government led by the socialist Prime Minister Mário Soares. Negotiations over membership were therefore backed by the domestic reforms that Portugal had undertaken and by the EEC’s aim of deepening and enlarging its market as a way of promoting economic growth. However, negotiations were also eased by the fact that, since 1947, Portugal had already been making efforts to open up its economy to other Western European countries, with the result that the only country that remained highly protected from Portuguese exports was Spain. Moreover, the Portuguese negotiators made relatively few demands, and those that it did make were centered on financial compensation for agriculture and fisheries. The development of the Delors packages was more of an unexpected bonus than it was the result of Portuguese pressure and concerns. This attitude of passivity was, in any case, rewarding, thanks to the favorable moment that the EEC economy was enjoying at the time of Portuguese accession.28 Portugal’s membership of the EEC was followed by the introduction of economic policy measures designed to compensate for the eventual negative effects of the country’s fully opening up its relatively backward economy to its more developed partners. These measures, financed by the Community budget, were designed to stimulate public and private investment in priority areas, which included the restructuring of agriculture and investment in infrastructure and communications, as well as in the education of the workforce. They enabled Portuguese agriculture to adapt to external competition, furnished the country with a modern transport and communications infrastructure, and improved the skills of the country’s human resources. Moreover, they had an impact at the level of macroeconomic balances, since the unilateral transfer of structural funds helped to finance the balance of current transactions. One must, however, acknowledge that not everything was positive about the application of the CAP and the use of structural funds, even though the benefits most likely exceeded the drawbacks.29 In any case, what matters here is that Portuguese membership of the EEC meant the continuation of the economic policy that had been pursued since 1947: the opening up of the economy coupled with state intervention, which was now carried out with the structural funds of the EEC. As Figure 1 shows, membership in the EEC paved the way for a second and most important wave of liberalization in Portuguese international trade, further increasing the openness of the economy. However, for Portugal, membership did not represent a turning point in its economic policy, but simply the continuation of an economic policy that had been followed since 1947. The integration of the European economies was given another push with the signing of the Maastricht Treaty in 1992, which established the EU and the EMU, the 1997 Growth and Stability Pact, and the implementation of a single currency between 1999 and 2002. Following the Spanish lead, the launch of the EMU was accompanied by an increase in the EU’s economic intervention capacity, made possible by the introduction of cohesion funds in the II Delors Package.30 The EMU resulted in a considerable increase in the intensity of economic relations between member states, particularly in terms of the trade taking place in goods and services and capital transactions. However, the EMU was established during a period of deep recession and declining economic growth, particularly in Spain and Portugal. In trying to assess the Portuguese experience of European integration after its accession to the EEC, the implementation of the EMU and the 2004 enlargement, it should be noted that since 1986, there has been little development in the EU’s public policies. In other words, growing economic integration has been accompanied only by the continuation of already existing compensation policies. This is negatively reinforced by the fact that national governments are less able to intervene in economic matters, since they can no longer control their own exchange rates to effect short-term changes to international competition, and since they are obliged to maintain the state deficit within the limits imposed by the Stability and Growth Pact. For Portugal, membership of the EEC, the signing of the Maastricht Treaty, and participation in adoption of the euro are all hugely important developments that make it possible to anticipate brighter prospects for economic development over the medium to long term. Portugal’s economy is small, so its development depends on ever greater integration into the international economy, and its adoption of the EU’s euro is the best guarantee of this. However, participation in an economic and monetary union with wealthier countries has had considerable effects on the Portuguese economy. Opening up the country’s trade to the outside world has led to a series of fundamental changes to the structure of the Portuguese economy, changes that are unequivocally linked to improvements in productivity, and therefore in the country’s ability to compete with the other EU countries. The international specialization of the Portuguese economy in 2005 was less favorable to an increase in the country’s economic growth than the situation that existed in 1992, since those sectors with lower levels of labor and capital productivity have become increasingly important. These are the clear and inevitable costs associated with adapting to a more competitive world. In the history of the European Communities, these costs of growth have tended to be compensated for by policies of public support to mitigate the negative effects, help less developed countries to increase their competitiveness, and allow for a balanced growth of the EEC/EU economies. These support mechanisms have, however, been worth little, not only because they reached levels that were too low in the context of the EU budget but also because the enlargement of the EU to twenty-five member states in 2004 increased the number of regions and countries that were competing for funds. Additionally, it is possible that the results of similar policies may be less impressive nowadays than they were two or three decades ago, precisely because modern economies are more competitive. As such, it is difficult to conceive of an immediate solution to the problems of adaptation faced by a poor country when seeking to integrate further into a community composed of countries that are richer and more developed in terms of industry, services, and market capital. It is also possible to conclude that there may be no solution, and that any attempts to correct the processes that are already underway will only serve to aggravate Portugal’s situation. The fact that there is no immediate solution does not, however, detract from the advantages that European integration has brought a country like Portugal. Nonetheless, we must take into consideration the problems that this integration has brought to the Portuguese economy. Furthermore, we have to be aware that the possible solution to the problems in the short term will inevitably be the introduction of measures designed to make existing norms more flexible. This was certainly what the European Commission was thinking when it allowed Portugal some leeway in its attempts to reduce the state’s budget deficit, extending the deadline until 2008. The strengthening of pan-European projects, such as those contained in the Lisbon Strategy or those related to the development of communications, may also play an important role in mitigating the disadvantages that integration has brought to the less developed countries and regions. Conclusion Economic integration has been a central feature of Western European history since the end of World War II. The intensity of this process has varied considerably during this period, depending in particular on the degree of involvement demonstrated by the different countries and the intensity of the areas in which the mechanisms of integration have occurred. The involvement of each country has depended on national political conditions and the actual dynamics of the integration process. This article has described the Portuguese path to integration by illustrating the economic policy of the country since the end of World War II; it has also shown how this policy was grounded in domestic intervention and the opening up of the economy to international competition, a key factor in a small country for which exports were essential. This policy was financed by Portugal’s joining such European institutions as the OEEC, the EPU and EFTA in the 1950s, and GATT at the beginning of the 1960s; its signing of the FTA with the EEC in 1972; its passing of the Economic Reconstitution Law; and its implementation of Development Plans in the 1950s and ’60s. In this sense, Portugal followed the same economic policy as other Western European countries. In other words, a peripheral and backward country, ruled by a dictatorship, emulated the economic policy of the democratic, industrialized, and more developed European countries. Thus, even before accession, government policies in Portugal did not differ substantially from those of the rest of Western Europe. Moreover, the country’s participation in the OEEC and the EPU, its membership of EFTA, and then the signing of the FTA agreement with the EEC, allowed Portugal to progressively internationalize its economy, adapting to European competition and integrating with the European economy. These earlier steps in integration paved the way for Portugal’s accession to the EEC in 1986. As a matter of fact, when the country eventually joined, most of its trade had already been opened up, and membership of the EEC was above all crucial for ensuring greater integration with Spain. Moreover, after joining the Community, Portugal continued to pursue a policy based simultaneously on state intervention (now involving the use of the structural funds of the EEC/EU) and a greater openness of the economy through its participation in the Single Market Program and then the EMU. Thus, for Portugal, joining the EEC did not represent a breaking point, but simply the continuation of an economic policy that had already been pursued since 1947.

References Allen, David. “Cohesion and structural funds: transfers and trade-offs.” In Policy-Making in the European Union, edited by Helen Wallace and William Wallace, 243–46. Oxford: Oxford University Press, 2000.. Amador, João, Sónia Cabral, and José Ramos Maria.“International trade patterns over the last four decades: how does Portugal compare with other cohesion countries?”Banco de Portugal Working Papers 14, 2007. Barbosa, Antonio Pinto, ed. O Impacto do Euro na Economia Portuguesa. Lisbon: Dom Quixote, 1999. Confraria, João. Desenvolvimento Económico e Política Industrial: A Economia Portuguesa no Processo de Integração Europeia. Lisbon: Universidade Católica Editora, 1995. Corkill, David. The Development of the Portuguese Economy: A Case of Europeanization. London: Routledge, 1999. Crafts, Nicholas. F. R. and Toniolo, Gianni, eds. Economic Growth in Europe since 1945. Cambridge, UK: Cambridge University Press, 1996. Crespo, Nuno, Maria Paula Fontoura, and Frank Barry. “EU enlargement and the Portuguese economy.” The World Economy 27, no. 6 (2004): 781–802. Dinan, Desmond. Europe Recast: A History of European Union. Hampshire, UK: Palgrave, 2004. ———. Ever Closer Europe: An Introduction to European Integration. Hampshire, UK: Palgrave MacMillan, 1999. Eichengreen, Barry. The European economy since 1945: coordinated capitalism and beyond. Princeton: Princeton University Press, 2006. Ferreira Eduardo de Sousa, Adriano Moreira, and Helena Rato, eds. Portugal Hoje. Oeiras: Instituto Nacional de Adminstração, 1994. Ferreira, J. Medeiros. “A estratégia para a adesão às instituições europeias.” In Portugal e a Construção Europeia, edited by António Barbosa de Melo, Manuel Lopes Lopes Porto, and Maria Manuela Tavares Ribeiro,137–66. Coimbra: Almedina, 2003. Griffiths, Richard T. “A Dismal Decade? European Integration in the 1970s”. In Desmon Dinan, The Origins and Evolution of the European Union, 169-90. Oxford: Oxford University Press, 2006. Hibou, Beatrice. “Greece and Portugal: convergent or divergent Europeanization?” In The Member States of the European Union, edited by Simon Bulmer and Christian Lequesne, 229–53. Oxford: Oxford University Press, 2005. James, Harold. International Monetary Cooperation since Bretton Woods. New York: Oxford University Press, 1996. ———. “O Estado e a industrialização em Portugal, 1945–1990.” Análise Social 29, no. 4 (1994): 1011–46. ———. “Portugal’s European integration policy, 1947–1972.” Journal of European Integration History 7 (2001): 25–35. Long, J. Bradford de and Barry Eichengreen, eds. “The economic development of the EEC.” In Elgar Reference Collection, vol. 12, Economic Development of Modern Europe since 1870. Cheltenham, UK: Elgar, 1997. Lopes, José da Silva. A Economia Portuguesa desde 1960. Lisbon: Gradiva, 1996. ———, ed. Portugal and EC Membership Evaluated. London: Printer, 1993. Milward, Alan S. The European Rescue of the Nation-State London: Routledge, 1992. ———. The Reconstruction of Western Europe 1945–1951. London: Methuen, 1984. Pinto, António Costa and Nuno Severiano Teixeira. “Portugal e a integração europeia, 1945-1986”. In A Europa do Sul e a Construção da União Europeia, 1945–2000, edited by António Costa Pinto and Nuno Severiano Teixeira, 17–43. . Lisbon: Imprensa de Ciências Sociais, 2005. Powell, Charles. “A adesão espanhola à União Europeia revisitada.” In Portugal, Espanha e a Integração Europeia: Um balanço, edited by Sebastián Royo, 191–216. Lisbon: Imprensa de Ciências Sociais, 2005. Rollo, M. Fernanda. Portugal e a Reconstrução Económica do Pós-Guerra: O Plano Marshall e a Economia Portuguesa dos anos 50. Lisbon: Instituto Diplomático, 2007. ———. Portugal e o Plano Marshall: Da Rejeição à Solicitação da Ajuda Financeira Norte-Americana, 1947–1952. Lisbon: Editorial Estampa, 1994. Royo, Sebastián. and Paul C. Manuel. “Introdução.” In Portugal, Espanha e a integração europeia: Um balanço, edited by Sebastián Royo, 23–56. Lisbon: Imprensa de Ciências Sociais, 2005. Sampedro, José Luis, Lyn Gorman, and Marja-Liisa Kiljunen, (The enlargement of the European Community: case studies of Greece, Portugal and Spain. London: Macmillan, 1983. Sapir, André, ed., Philippe Aghion, Giuseppe Bertola, Martin Hellwig, Jean Pisani-Ferri, Dariusz Rosati, and José Viñals. An Agenda for a Growing Europe: the Sapir Report. Oxford: Oxford University Press, 2004. Vallera, João de. “The negotiation process.” In Portugal: A European Story, edited by Alvaro de Vasconcelos and Maria João Seabra, 57–78. Cascais, Portugal: Principia, 2000. Vilaça, José Luis da Cruz. “Portugal and European integration—negotiations and legal implications.” In Portugal. A European Story, edited by Alvaro de Vasconcelos, and Maria João Seabra, 79–87. Cascais: Principia. Xavier, Alberto P. Portugal e a Integração Económica Europeia. Coimbra: Almedina, 1970.

Notes 1 University of Lisbon, Institute of Social Sciences. 1600-189, Lisbon, Portugal E-mail: [email protected] Received for publication: 19 February 2013 Copyright

2013, ISSN 1645-6432

|

||||||||||||||||||||||||||||||

| ...... | ....................................................................................................................................................................................................................................................................... | ||||||||||||||||||||||||||||||

| COPYRIGHT@ 2008 E-JOURNAL OF PORTUGUESE HISTORY, ALL RIGHTS RESERVED webdesign TVM DESIGNERS | |||||||||||||||||||||||||||||||